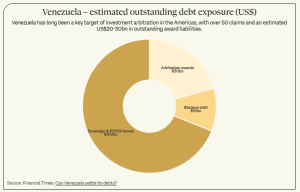

Venezuela has an estimated $20 billion to $30 billion in outstanding award liabilities.

LATINVEX SPECIAL

Freshfields

After close to two decades as a pariah State, Venezuela now stands at a crossroads. Under close oversight from the United States government, the country is moving toward a structured recovery. Notably, a US Executive Order in January 2026 placed Venezuelan oil revenues under US control, aiming to support both oil sector reconstruction and reform of Venezuela’s Petroleum Law.

These changes are likely to fundamentally reshape foreign investment models, but significant uncertainty remains. Venezuela still lacks strong and independent institutions, and the political transition creates legal grey areas, with many countries not recognizing the current administration.

For award creditors and investors, this presents an opportunity to revisit strategies for extracting value from awards and dormant claims, though caution remains essential.

Turning awards into strategic assets

Venezuela has long been a key target of investment arbitration in the Americas, with over 50 claims and an estimated $20 to $30 billion in outstanding award liabilities.

The last decade saw attempts at direct enforcement of some of those awards against assets of Petróleos de Venezuela SA (PDVSA), such as the shares of PDV Holding (which in turn holds major US-based refiner and distributor, Citgo) in proceedings before the US District Court for the District of Delaware.

In light of recent events, negotiation may offer an alternative path to realizing value. With the possibility of a sovereign debt restructuring, award creditors could consider using their unpaid awards as negotiation leverage.

Securing a new deal: Credits and reinvestment

The Venezuelan legislature has passed a new Petroleum Law endorsed by the United States. This law removes the requirement that state-owned PDVSA retains majority control, clarifies legal uncertainties under the old regime, greatly reduces fiscal burdens and allows access to arbitration in the event of disputes.

US involvement and the reform of the Petroleum Law has renewed global interest in Venezuela’s energy sector and related industries. Those who can use their legacy awards or trade receivables towards new commercial ventures are well positioned. Concrete advantages may include:

- Priority status in upcoming joint venture opportunities;

- Enhanced contractual protections and license extensions; and

- More favorable fiscal terms tailored to the new economic reality.

However, with legal reforms still underway and broad recognition of the government unsettled, investors should proceed with caution and careful due diligence. Contracts signed with the current administration may face challenge in courts abroad, or in Venezuela itself if prospects of a political transition materialize. Recent years have also seen Venezuela withdraw from the ICSID Convention and some investment treaties, affecting international protection.

Practical takeaways

For investors and creditors with Venezuelan arbitration (claim or award) exposure, agility is the key to securing the best results.

- Monitor US policy developments: In addition to monitoring US policy developments at the Office of Foreign Assets Control, also watch for key moves by the State Department’s Foreign Terrorist Organization designations and shifts in how oil revenues are managed, as these can affect both timing and leverage.

- Stay informed of local developments: As we have seen with the Petroleum Law, local initiatives under the guidance of the US are quickly changing the local regulatory landscape and need to be taken into account. Look out for any new legislation to protect foreign investment or steps to rejoin multilateral institutions such as ICSID.

- Consider the secondary market: For those seeking a quicker exit, renewed activity on the secondary market (e.g. sale of awards or sale of claims to investment funds) could unlock new liquidity options, though be aware that pricing remains highly sensitive to restructuring developments.

- Develop reinvestment scenarios: Consider debt-for-equity swaps or “credit-to-contract” conversions but do so with as many protections in place as possible. In this uncertain environment, contracts approved or guaranteed by the US may offer additional comfort.

This article was written by Freshfields attorneys Nigel Blackaby KC, Sylvia Noury, Dr. Carsten Wendler, Natalia Marina Zibibbo and Gonzalo Salazar.

Nigel Blackaby is Partner and Co-Head of Latin America Practice at Freshfields.

Sylvia Noury is a partner in the International Arbitration Group.

Dr. Carsten Wendler works in the international arbitration group, and acts in both commercial and investment treaty arbitration proceedings, with a focus on Europe and Latin America.

Natalia Marina Zibibbo works in the international arbitration group, and focuses on commercial and investment arbitration in Latin America.

Gonzalo Salazar is an associate in Freshfields’ International Arbitration Group.

This article was originally published in the Freshfields Arbitration Trends Report 2026.

Republished with permission.

RELATED ARTICLES

Venezuela After Maduro: A Cautionary Note for Business

Venezuela After Maduro: No Quick Recovery

Venezuela: An Ounce of Euphoria, A Ton of Uncertainty

Maria Corina Machado’s Nobel Prize Lecture

More Venezuela coverage