China’s export restrictions on rare earth magnets have had a sudden impact on India’s burgeoning electronics manufacturing, as the country doesn’t manufacture them.

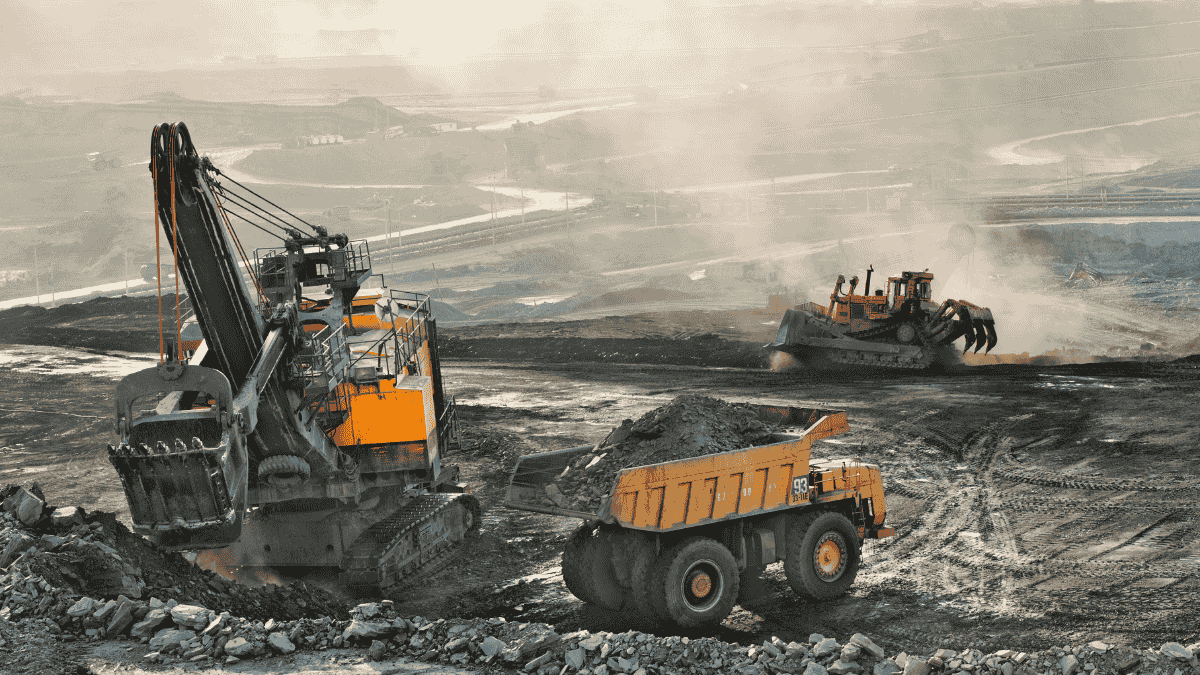

Assorted critical minerals and rare earth elements are the cornerstones of the high-tech manufacturing sector that India is focusing on to accelerate growth and create jobs. These minerals serve as the building blocks for power windows, electric vehicle (EV) batteries, renewable energy storage systems, semiconductor manufacturing, defence production, and much more.

That is why globally, critical minerals are the most sought-after resources now and are even defining geopolitics. In fact, China’s move in April to tighten export restrictions on a host of rare earth elements has hit supply chains across many parts of the world, and the US, seemingly a prime target, is seriously impacted. For India, the China episode, however, has also exposed how under-prepared the country is in ensuring the supplies of these resources.

Of course, India started an auction for critical mineral blocks in November 2023, and five rounds have already taken place. The National Critical Mineral Mission (NCMM) was launched in January this year with a public-sector outlay of Rs 34,300 crore over seven years. Coal India, NTPC, and others have announced overseas ventures to explore battery minerals, while plans are afoot to enter into bilateral pacts with mineral-rich African and Latin American countries.

According to industry sources and experts, these policy initiatives have come a bit late. Many countries, including some Asian peers, have moved much ahead of India in this area. While the response to India’s auction process has been lukewarm, potential investors want the policy regime to be tweaked to produce better outcomes. Last week, the mines secretary VL Kantha Rao hinted at further changes in policy to bolster the NCMM.

Currently, India remains 100% import-dependent for most critical minerals, including lithium, nickel, cobalt and germanium. Import of copper, also a key input for high-tech industry, has skyrocketed in recent years (up 10 times in a decade), with domestic production declining.

Even as demand for these minerals surges, industry remains cautious about making large-scale investments due to uncertainties in resource viability, infrastructure, and regulatory clarity. “The current auction regime treats critical minerals in almost the same manner as bulk minerals. Auctions may not be the best way to operationalise critical mineral blocks,” said Arun Misra, CEO, Hindustan Zinc, and ED at Vedanta.

Sector experts say that the lack of detailed resource data has hampered the government’s plans to achieve self-sufficiency in critical minerals.

Under the United Nations Framework for Classification of Resources (UNFC), mineral exploration follows four stages: G4 (reconnaissance), G3 (prospecting), G2 (general exploration), and G1 (detailed exploration). The G4 and G3 stages provide low-confidence resource estimates, while the G2 stage represents moderate confidence. The G1 stage offers high-confidence estimates, derived from detailed investigations and direct sampling. In India, only 10% of mineral blocks are designated for mining leases, and are typically auctioned at the G2 level, while G1 auction is almost non-existent.

“The reluctance among experienced private and foreign players is because the recovery rate for these minerals in India is very low, and requires extensive investments in exploration, refining, production facilities and technology,” Misra explained. He also noted that companies with no demonstrated expertise in mineral processing are entering the critical mineral segment.

Apart from limited exploration and mining, the non-availability of beneficiation technologies is also a problem. “Geopolitical risks and dearth of funding opportunities due to adverse risk perception are challenges,” according to Suvendu Bose, partner, Grant Thornton Bharat.

“Mining projects usually take over a decade to start commercial production. The government must act swiftly by offering incentives and ensuring pre-embedded clearances for critical mineral blocks,” BK Bhatia, director general, Federation of Indian Mineral Industries, said.

On average, it takes over 16 years to develop lithium mines from the discovery stage to the first production. However, the actual time frame can vary significantly based on factors like mine type (hard rock versus brine) and location.

The Geological Survey of India has undertaken 368 exploration projects for critical minerals over the past three years, with 195 projects underway in FY25, and plans to initiate 227 projects for various critical minerals in FY26.

Overall, while the policy push might have started creating an enabling environment, further focus on auction efficiency, investor confidence, and infrastructure will be crucial, said an analyst.

The scale and speed still need to catch up with the surging demand for EVs and energy storage, says Rajat Verma, founder and CEO, Lohum. “Only a fraction of India’s large mineral reserves have been explored and utilised, leaving significant potential untapped, especially for lithium, copper, and cobalt,” Verma said.

India’s pursuit of minerals is also likely to face challenges due to China’s significant presence on the continent. Adding to India’s woes, China’s export controls have forced the importing countries to look for alternative sources, squeezing the supplies available for India.

A trade deal with Africa will assist India in meeting its mineral requirements, industry players feel. However, here too, there are possible impediments. “The Centre may face challenges in navigating any trade alliances with Africa, particularly in view of the prevailing local socio-political issues. China’s dominance in African countries may also impede our progress,” Bhatia said. “We need to address these issues at the government-to-government level before entering into such alliances,” he added.

Rajib Maitra, partner, Deloitte India, said India’s heavy import dependence makes it vulnerable not only to trade disruptions but also to price shocks and supply bottlenecks. Analysts suggest incentivising the setting up of processing plants by providing capital incentives, tax holidays and viability gap funding. “A clear-cut policy for critical minerals needs to be developed, with a focused approach to encourage exploration, processing and downstream value addition,” said Bose

(Tomorrow: Is auction the best way to lure investors?)