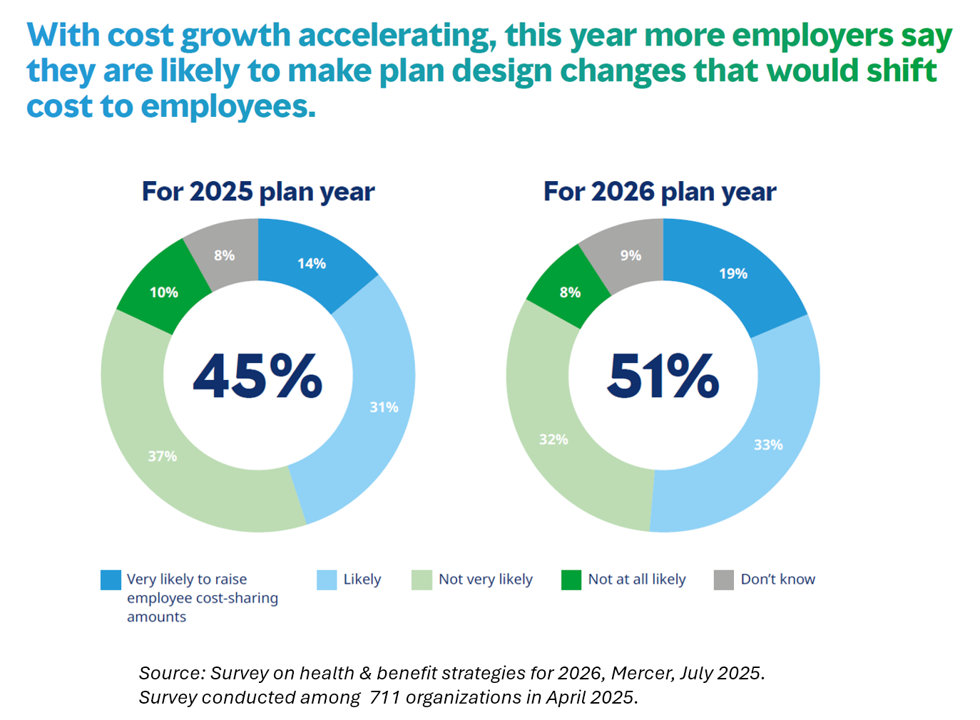

At least one-half of employers will likely raise employee cost-sharing amounts in 2026, according to the Survey on health & benefit strategies for 2026 from Mercer.

Mercer surveyed 711 organizations for this study, fielded in April 2025, to assess employers’ views on and strategies for health benefits in 2026.

There are three challenging pillars underlying employers’ 2026 approaches to workers’ benefits:

- How to disrupt cost growth with what Mercer coins as “bolder” strategies

- How to consider and address all dimensions of affordability, and,

- How to design and implement inclusive benefits that build workforce resilience.

These are indeed tough challenges as health benefits costs continue to increase well beyond the level of general price inflation, Mercer points out. Some of the “bold” moves employers could take might be to offer medical plans with no or low deductibles, noted by 37% of organizations in the study. (Note: this would inevitably be designed as a narrow network [aka “skinny plan”] that could be acceptable to lower-age employers not managing chronic conditions).

Top of employer benefits’ managers minds for 2026 is the cost of prescription drugs — specifically the annual cost per employee increase of 8.4% for specialty drugs in 2024 (calculated after rebates).

This growth curve was largely driven by growing utilization of GLP-1 medications, which have become a major direct-to-consumer category for an Rx, impacting many aspects of consumers’ lives — from food shopping to clothing, travel plans and many aspects of fast-moving consumer goods (FMCGs) and the retail landscape.

In addition to revisiting the cost and reimbursement of the GLP-1 therapies, employers will also look at evaluating new approaches to contracting for this benefit, and look more broadly at relationships with (and benefits from) pharmacy benefit management companies (PBMs).

Another key cost-driver, top-line, for employers has been behavioral health care — which generates clinical and social benefits to employees and families, productivity to organizations, and more supportive work environments.

Mercer found that organizations will offer a median of six counseling sessions annually, shown in the circles chart, with the most common services for behavioral health covering in-person counseling, coaching via text, therapy via text, online peer support groups, and online self-paced cognitive behavioral therapy.

Health benefits addressing women’s health and well-being across her lifespan are also gaining attention (and investment) among 59% of employers, who will offer at least one of the benefits listed in the table. These include, by popularity, lactation support (36%), support for high-risk pregnancy (35%), pre-conception family planning (34%). return-to-work support (31%), postpartum mood disorders (e.g., depression, anxiety, for 29% of organizations), and support after pregnancy loss (27%).

On the downside of Mercer’s findings, many fewer organizations plan to collect data to understand health equity and social determinants of health,

On the upside, 3 in 4 employers say that severe weather has affected their workforce in the past two years; employers are moving to implement programs to support employees affected by extreme weather events.

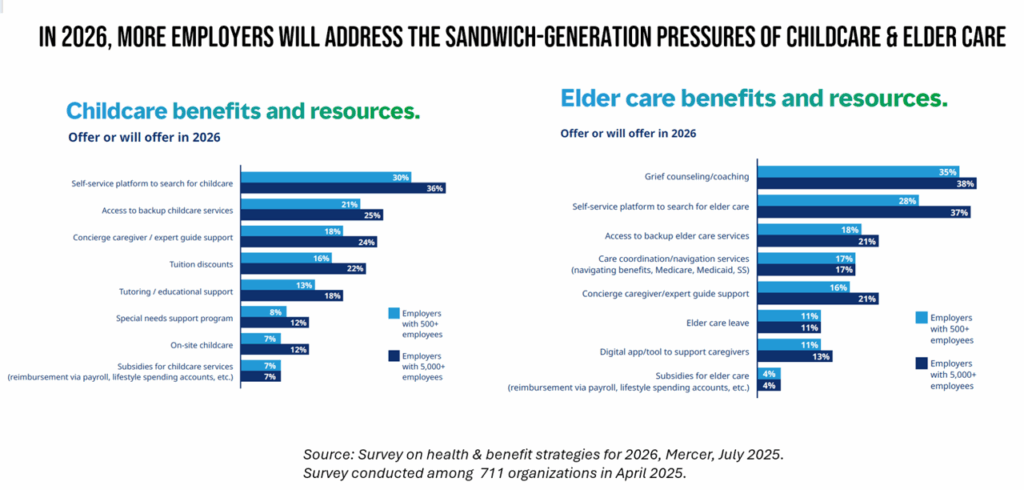

Health Populi’s Hot Points: A key factor bolstering workers’ needs and demands for behavioral and mental health support is caregiving: for both children and for older people in workers’ lives.

In this last chart, I feature two charts from Mercer’s report which are life-span bookends for workers in the sandwich generation. Given longevity at the elder care part of the aging spectrum, and the reality of women’s work at home and at the workplace, the data are clear here: employers are trying to address the pressures of caregiving workers while trying to balance affordability, inclusivity, and health benefit coverage.

On the childcare front, a plurality of organizations will offer self-service platforms to search for childcare, access to backup childcare services, concierge and caregiver/expert guide support. For eldercare, a plurality of companies will offer grief counseling and coaching, self-service platforms to seek elder care, and access to backup eldercare services.

Few employers will offer subsidies for childcare or elder care, nor expert guide support throughout the worker’s caregiving journey(s).

As more employers look to add to workers’ financial risk for health care costs — combined with workers’ pressures for caregiving of younger and older loved ones — 2026 will bring fiscal, mental, and physical challenges to the workforce — even for those fortunate enough to receive health benefits at the workplace.