The BRICS meeting in Rio on July 6th and 7th gives a snapshot of the great power competition between China and the United States in different regions around the world, including Latin America. China has become the largest trading partner for many countries in Latin America, investing heavily in infrastructure and forging political alliances that further its strategic objectives. For its part, the Trump Administration of the United States issued the statement that those participating countries will face increased tariffs. The statement was the continuation of exercise and assertion of its authority for the past and present century.

The positioning of various BRICS members and participating countries is particularly telling of what the great power competition means in the region and also globally. Brazil’s Lula hosted the meeting aiming to showcase its foreign policy leadership, not necessarily antagonizing the West. Russia is still going through the war in Ukraine, and Putin attended only online. India’s Modi was present as well as Ramaphosa from South Africa. No show of Xi Jinping was notable, although Premier Li Qiang was attending. Besides the BRICS core, other countries also showed promotion of their interests. Iran, for one, joined the group in 2024 and sent a ministerial level delegation to rebuke recent strikes on Iran.

As the United States appears to be pulling back from its traditional leadership role in the world, China is seizing the opportunity to expand its influence and reshape global dynamics. Through a combination of state-driven development policies and active international engagement, Beijing has positioned itself as a major player in the Global South, extending its reach beyond Asia to regions such as Africa and Latin America. China’s increasing presence in the region has been mainly driven by the Belt and Road Initiative (BRI) and a surge in trade volumes, marking a major shift in the region’s economic landscape. Many experts point to China’s use of “infrastructure diplomacy”—financing ambitious, strategic infrastructure projects across the region—as a key factor in this rise.

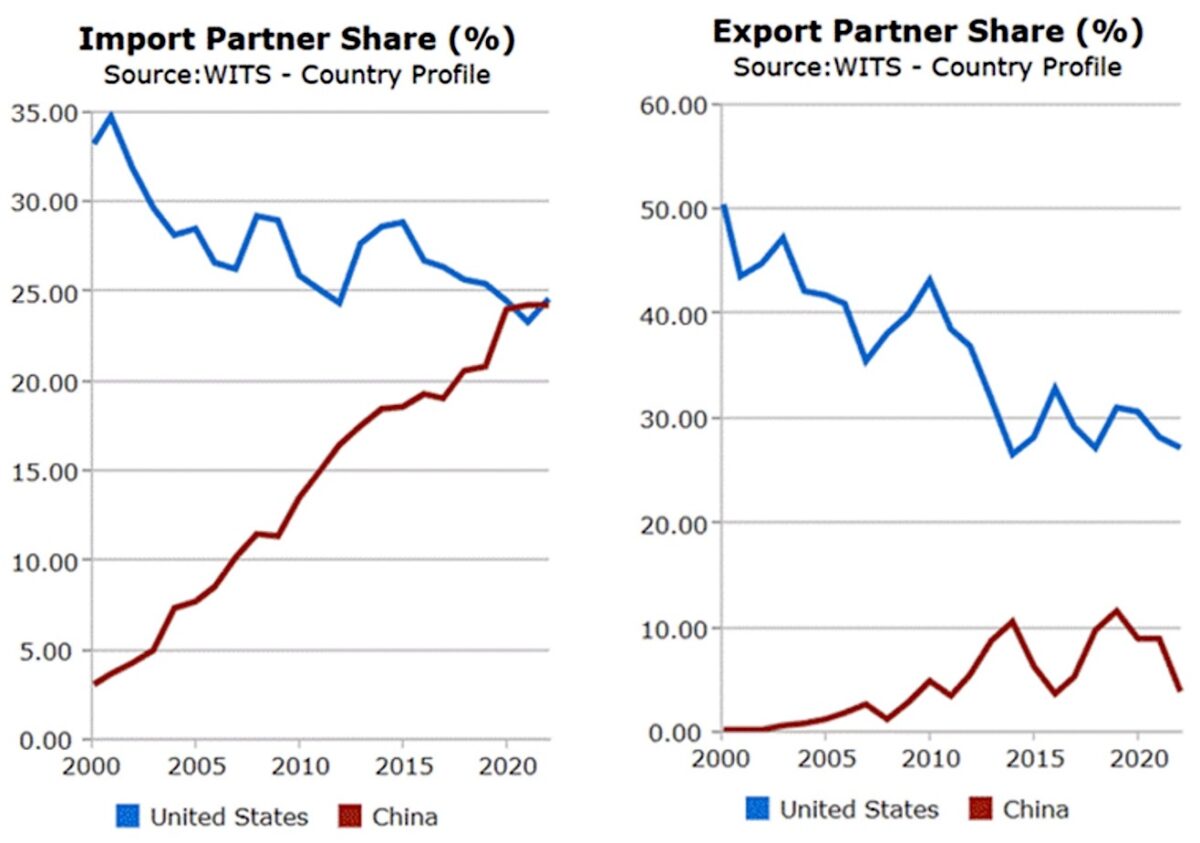

The numbers tell a compelling story. Trade data from the World Bank (Figure 1) shows that in the past ten years, China has overtaken the United States as the leading trading partner for much of the region, upending a dynamic that had held steady since the early 2000s. Beyond trade, China’s influence deepens through the 22 countries in Latin America and the Caribbean that have joined the Belt and Road Initiative. Chinese loans have poured in, funding major energy, infrastructure, and development projects that have reshaped local economies. China’s push isn’t just economic—it’s political too. Beijing has taken steps to strengthen cultural ties, increase academic exchanges and boost tourism in Latin America, including waiving visa requirements for travelers from some countries. This multi-faceted approach highlights China’s pragmatic mix of economic self-interest and strategic diplomacy as it works to secure resources, expand markets, and bolster its global standing.

On the other hand, the United States has long been a strategic ally and key trading partner for Latin America. Agencies like USAID have funneled millions of dollars into economic and military initiatives across the region. With the recent changes in the aid policy, immigration policy, and tariff policy, Washington’s recalibration of its foreign policy are transforming the geopolitical balance in Latin America and the Caribbean. As both powers deploy their strategies — from deepening economic ties to defending national interests — the decisions of Latin American states remain critical in shaping their alignments with global powers. The ultimate outcome is still up in the air, but one thing is clear: power in the region is actively being renegotiated.

The diverging approaches from China and the US have set the stage for a broader reconfiguration of power in Latin America and the Caribbean. Yet, it’s essential to recognize that each country’s internal decisions and policies also play a critical role in shaping this shifting landscape. Colombia provides a case in point. Historically, it has maintained close diplomatic ties with the United States while keeping China at arm’s length. Unlike countries like Brazil, Argentina, and Peru, Colombia has received relatively little Chinese infrastructure investment. However, with the election of president Gustavo Petro—the first left-wing president in the country’s history—Colombia has taken decisive steps to strengthen its relationship with China, presenting new challenges for the United States to maintain its strategic foothold in the country. We observe – both on political and economic dimensions – that the changes in China’s strategy, coupled with Colombia’s domestic policies, have reduced the country’s dependence on the US while increasing its desire to integrate with China.

Politically, Colombia and the United States have long enjoyed a strong diplomatic relationship, as reflected in their shared memberships in international organizations, high-level dialogues, and multiple bilateral agreements. However, diplomatic tensions have emerged in recent years. Disputes between the two leaders, the change of course of USAID, and a significant drop in new bilateral agreements over the past four years have contributed to a shift in this traditionally stable partnership. Against this backdrop, diplomatic ties between China and Colombia have strengthened. In 2023 alone, both countries signed 12 cooperation agreements in trade, technology, and economic development, upgraded their relationship to a strategic partnership, and Colombia’s entry into the Belt and Road Initiative during recent China – CELAC Forum in May. Colombia also joined the BRICS New Development Bank a few weeks after that Forum.

Economically, the US has traditionally been Colombia’s largest trading partner, backed by a free trade agreement and significant investment. Yet, in recent years, the share of US trade has steadily declined, while China’s footprint has grown (see figure 1). Although there’s no formal trade agreement, ties have strengthened during the current administration, including the opening of a Buenaventura-Shanghai trade route in 2025. Additionally, China’s “infrastructural diplomacy” has significantly grown: over 100 Chinese companies now operate in Colombia, and major infrastructure projects like Bogotá’s Metro Line 1 and the Regiotram are underway, along with investments in mobility, technology, and health.

Latin America, and Colombia in particular, finds itself at the center of a geopolitical tug-of-war with China’s calculated investments and the US’s shifting policies. While Beijing leverages trade, infrastructure, and cultural diplomacy to expand its influence, Washington’s recalibration of its foreign policy leaves room for new alliances and opportunities. Our analysis shows that power reconfiguration is not merely a product of external rivalry. It is driven by the choices each Latin American nation makes. As Colombia’s case demonstrates, the region’s destiny hinges not just on global superpowers, but on its own internal political decisions and developments. The coming years will test how Latin America navigates these shifting currents.

Figure 1: China vs. US Import and Export Trends

Drawn by the authors using data from the World Bank.

Further Reading on E-International Relations