If you went shopping for something that cost $35,119 in 2025, which would you most value?

- A new 2025 Toyota RAV4 Hybrid with some extras on board?

- A Canyon BYO playground set for your yard, school, or social-athletic club? Or,

- Healthcare coverage for a family of 4 in the form of a PPO?

Welcome to this year’s 20th anniversary edition of the Milliman Medical Index (MMI), which I’ve looked forward to reviewing for most of its two-decade history. [You can read my annual takes on the MMI here in Health Populi by searching “MMI” and the year of publication in the search box above].

![]()

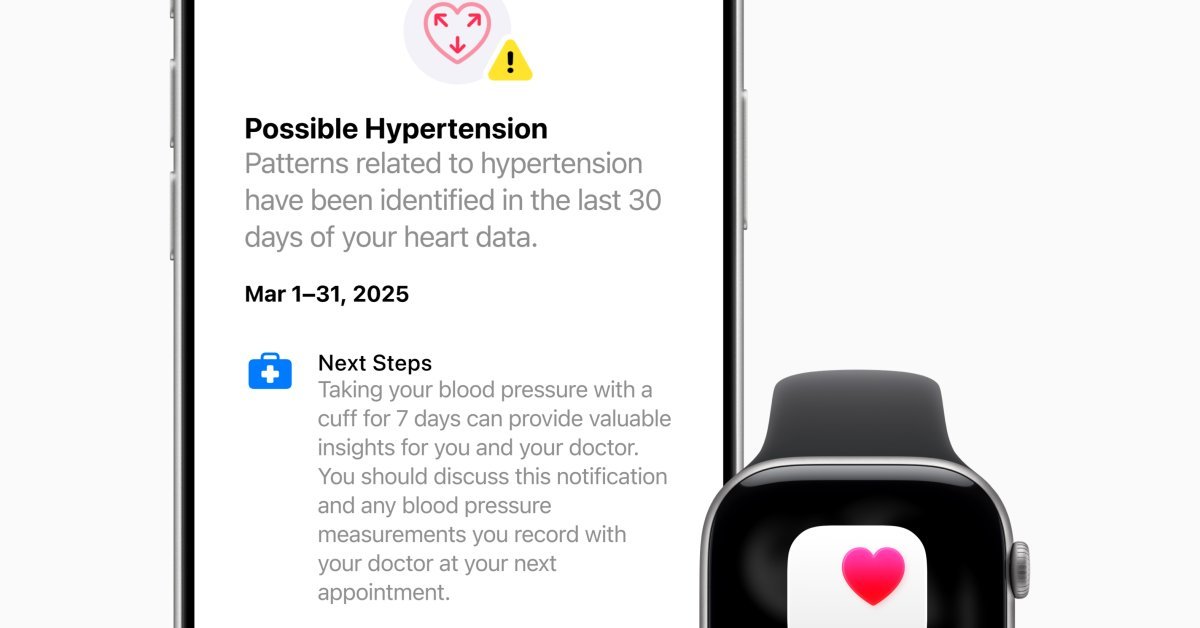

This year, we learn that outpatient care and pharmacy were the two line items most responsible for driving the PPO cost up to over $35K: pharmacy costs rose 9.7% and outpatient facility care grew by 8.5% for the average patient.

MMI is quick to note that an “average patient” in the study methodology is based on the original MMI family for tracking consistency. As conceived 20 years ago in this model, the “average” family today can look quite different in terms of parental composition and age of parents raising the (theoretical) two children, as well as fertility trends and number of children in the model family. (If you’re keen to test these assumptions and how the MMI can change, Milliman welcomes you to do so using an interactive tool that enables you to change the family composition and do sensitivity analyses).

MMI looks into five components of spending for the annual index, topped with outpatient facility care (which comprised about one-third of spending on average), professional services (visits to clinicians, etc.) making up 28% of spending, pharmacy (one in $5 of spending, inpatient (hospital) care constituting 17% of spending, and other line items at 2% of the remainder.

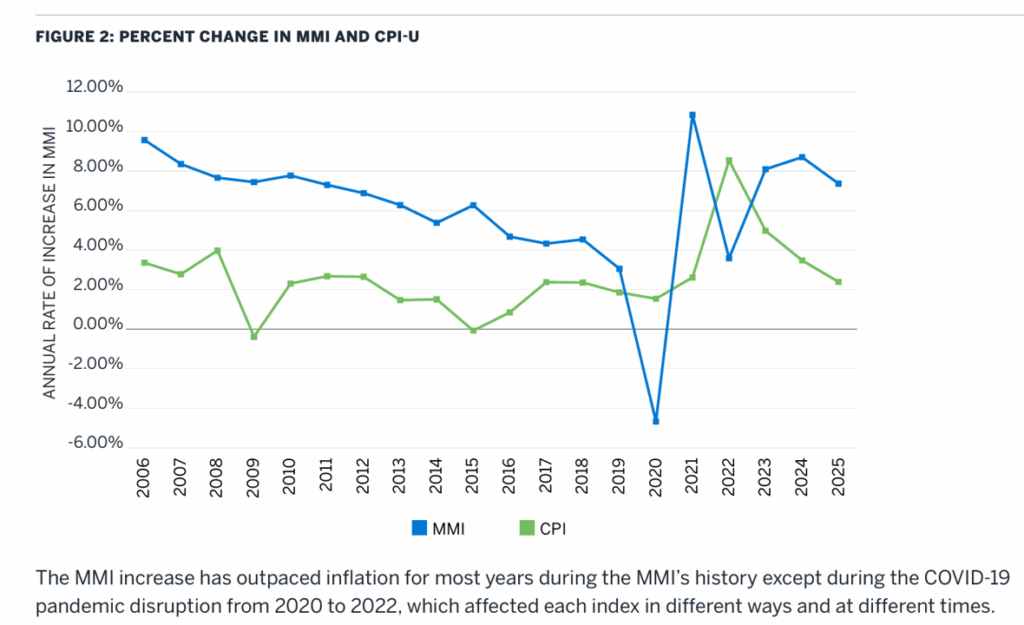

The context for health care spending increases overall and then by segment of costs lives in the bigger picture of inflation, as measured by the Consumer Price Index (CPI). As the line chart here illustrates, health care spending spiked in 2021 following a dramatic fall during the height of the COVID-19 “pandemic disruption” from 2020 to 2022, then fell and rose again by 2023. In the past year we can see that, while the MMI percent change was higher than consumer price inflation by a factor of nearly 4 times, the rate of growth slightly fell from 2024-2025.

Health Populi’s Hot Points: As I focus on patients-as-payors and health care consumers, I usually portray the annual MMI full health plan expense comparing it to a major consumer product or expense — such as a new car, a year of college, and this year, I found the playground set which for me is a flavor of health/activity spending especially suited for younger health consumers.

In this bar chart from the 2025 MMI report, I appreciate that Team Milliman compares the Index health care coverage cost increase with growth of other consumer-facing spending. The last bar chart shows those comparisons, noting the MMI growth between 2005 and 2025 (the 20 years’ journey of the Index) far exceeded that of wages, bread, and electricity.

It’s wages that U.S. workers have traded off for health care coverage, for those working people who have received health care coverage from the workplace (that is, employer-sponsored health insurance).

In 2025, we’ve entered a slow-wage growth era as far as we can tell, given the many uncertainties and forces shaping U.S. householders’ home economics — consider the impact of tariffs on various consumer goods (important to assess by country for, say, food and agricultural product spending versus electronics (this week’s news about tariffs potentially hitting Apple and Samsung quite specifically), as well as potential negative impacts on raw materials for building/housing (with younger Americans continuing concerns about housing costs).

MMI 2025 continues to reinforce the reality for American families and individuals that health care costs are part of overall kitchen table economics, In a year where tariffs as de facto taxes on various segments of consumer spending, watch for health citizens – as – medical bill and plan payors to seek relief for spending on health care services and products. This could hit medical offices managing patient bill paying (e.g., revenue cycle management), consumer spending on prescription drugs and medicines that have been consumer-driven (such as the GLP1 category), and personal medical spending for elective kinds of surgeries, from sports to dermatology and aesthetics.

The uncertainties facing Medicaid, as well as wild card potential for Medicare and Social Security, may also impact providers’ (both inpatient and outpatient) operating margins depending on whether patient volumes persist or decline.

The interconnectedness between consumer spending, health care spending, and MMI’s lens on health plan costs and medical trend cannot be overemphasized. I’ll be addressing this in my next post here in Health Populi as I consider the context for the upcoming AHIP 2025 Conference. Stay tuned!