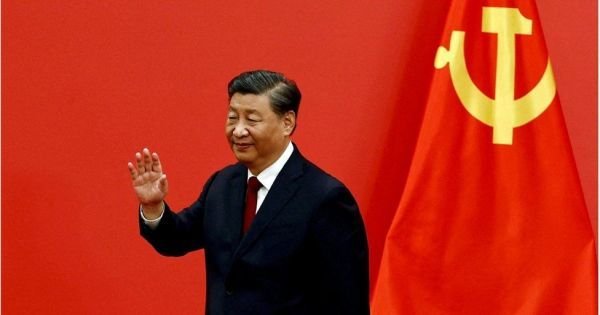

China’s Xi calls to make Renminbi “a powerful currency,” as Trump is ready to change Fed’s chair

The timing of Xi’s announcement is strategically significant since it coincides with notable weakness in the US dollar, which has fallen to a four-year low

China’s President Xi Jinping has called for the renminbi to achieve global reserve currency status, “a powerful currency” according to remarks published on Saturday in Qiushi, the Chinese Communist Party’s flagship ideology journal.

The commentary, adapted from a speech Xi delivered to regional officials in 2024, defines what Beijing means by a “strong currency” in functional rather than symbolic terms. Xi stated that China needs to develop “a powerful currency that can be widely used in international trade, investment and foreign exchange markets, and attain reserve currency status”, in other words an explicit challenge of the US dollar’s dominance.

Beyond currency rhetoric, Xi outlined three core institutional pillars required to support reserve status. First, China needs “a powerful central bank” capable of effective monetary management and capable of attracting global capital. Second, the country must develop globally competitive financial institutions. Third, cities like Shanghai and Shenzhen must evolve into genuine international financial centers able to “attract global capital and exert influence over global pricing.”

The timing of the announcement is strategically significant. It coincides with notable weakness in the US dollar, which has fallen to a four-year low, and comes amid heightened global monetary uncertainty with central banks reassessing their exposure to dollar assets.

In effect President Donald Trump’s trade policies, Federal Reserve leadership transition, and rising international frictions have created what Beijing perceives as an opportune moment. Trump has announced his new candidate as chair of the Federal Reserve, Kevin Warsh, and in a release from the White House describes the nominee as “exceptionally well-prepared to lead the world’s most influential central bank, with a distinguished background including degrees from Stanford University and Harvard Law School, prior roles as a Morgan Stanley executive and top economic advisor to the Bush Administration, and service as the youngest-ever Federal Reserve Governor — where he helped steer the institution through the 2008 financial crisis”

However despite Xi’s ambitious vision, the renminbi’s current role in the global financial system remains modest. According to International Monetary Fund data from the third quarter of 2025, the yuan’s share of global reserves stood at 1.93%. This pales in comparison to the U.S. dollar, which accounted for approximately 57% of global reserves (down from 71% in 2000), and the euro at roughly 20%.

The renminbi has made significant inroads in specific areas. Since Russia’s full-scale invasion of Ukraine in 2022, it has become the world’s second-largest trade finance currency. The Russia-Ukraine conflict fundamentally accelerated de-dollarization efforts as Western sanctions pushed Russia and its trading partners toward alternative payment systems. Yet despite progress in trade settlement, the currency’s role in official global reserves remains minimal.

Han Shen Lin of The Asia Group clarified Beijing’s immediate objectives: “Beijing wants the yuan to be a serious global currency—not necessarily to replace the dollar overnight, but to be a strategic counterweight that limits US leverage in a fracturing financial order.” This pragmatic approach acknowledges both the dollar’s entrenched position and China’s own structural constraints.

As to Kevin Warsh, he was once referred to as an inflation “hawk”, a banker who prioritizes fighting inflation, compared to a “dove” who prioritizes growth and jobs.

From Warsh’s previous time at the Federal Reserve, he established a strong reputation as an inflation hawk. Even in the aftermath of the global financial crisis of 2008, Warsh was more worried about inflation than jobs.

Given Trump’s past conflict with the current Fed chairman Jerome Powell around cutting interest rates, Warsh seems somehow curious. But it is also true that in recent months Warsh has moderated his views, echoing Trump’s criticism of the Fed and demands for lower interest rates.