In November 2024, Oxford Nanopore Technologies has teamed with UK Biobank, NHS England, and Genomics England to use their cutting-edge technology to sequence 50,000 samples from UK Biobank, the world’s most advanced source of health-related data. Oxford Nanopore and UK Biobank will continue to collaborate with the government to better the insights derived from their data and transform them into benefits for NHS patients.

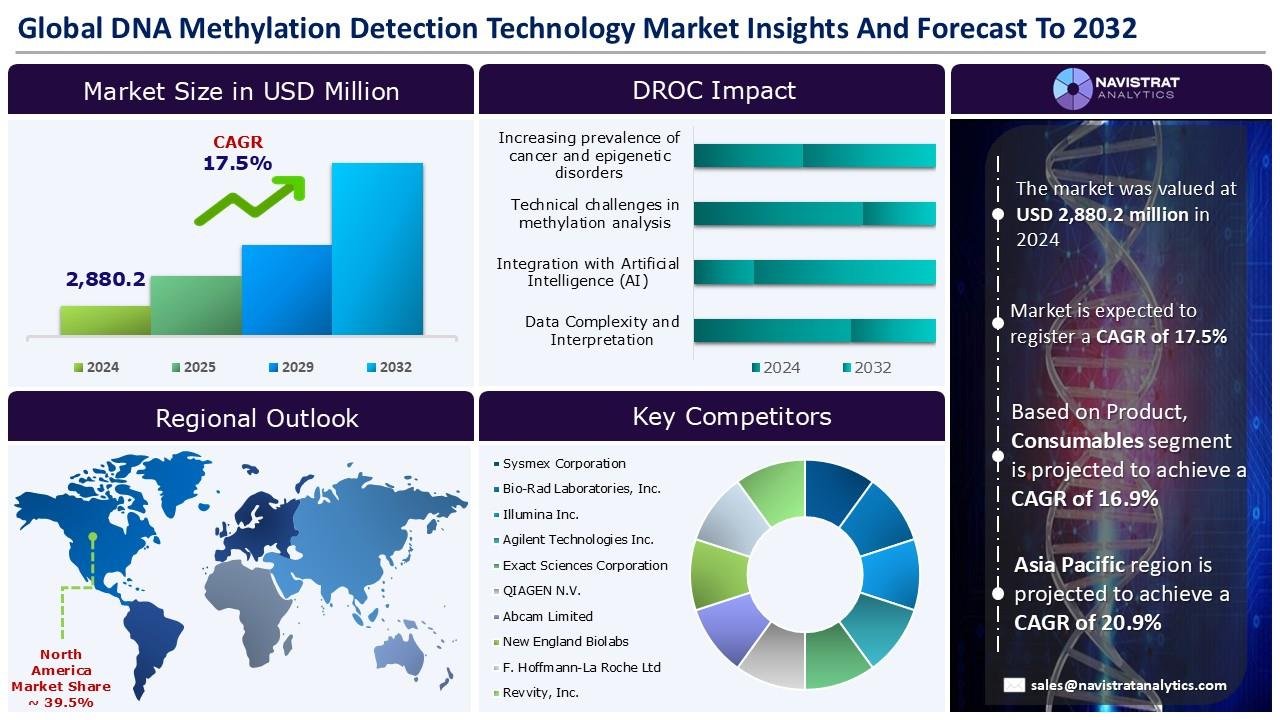

However, there are certain hurdles to overcome. One significant challenge is the technical challenges in methylation analysis. The biggest problem for DNA methylation is diversity among cells produced from the same source. Furthermore, many existing techniques still struggle to distinguish 5-methylcytosine (5mC) from other types of DNA modifications, such as hydroxymethyl cytosine. Furthermore, the lack of consistency and reproducibility across different platforms and methodology presents a substantial barrier to the use of DNA methylation-based biomarkers in clinical settings, as highlighted in numerous research and reviews in the field.

Want to Know What’s Fueling the DNA Methylation Detection Technology Market Growth? Get Exclusive Report Insights Here:

Segments market overview and growth Insights

Based on the application DNA methylation detection technology market is segmented into clinical research, diagnostics, gene therapy, and others. Diagnostics segment is expected to register the largest market revenue share during the forecast period. Cancer is the leading cause of illness and mortality worldwide, highlighting the necessity of early detection and intervention for successful treatment and better patient outcomes. Circulating tumour DNA (ctDNA) methylation, a novel liquid biopsy biomarker, has emerged as a promising tool for early cancer detection, monitoring, and prognosis prediction. As a non-invasive method, liquid biopsy overcomes the limitations of traditional tissue biopsy. Among biomarkers, ctDNA methylation has received a lot of interest because of its excellent specificity and early detection capabilities across a wide range of cancer types.

On June 2023, researchers at the Perelman School of Medicine at the University of Pennsylvania have developed a new method for mapping particular DNA markings known as 5-methylcytosine (5mC), which regulate gene expression and play important roles in health and illness. The novel technology enables scientists to profile DNA using very little samples without destroying the sample, making it potentially useful in liquid biopsies (testing for cancer markers in the bloodstream) and early cancer detection. Furthermore, unlike existing methods, it can clearly distinguish 5mC without becoming confused with other common markers.

Regional market overview and growth insights

North America held the largest market share in the DNA methylation detection technology market in 2024, driven by increase in prevalence of chronic disorders and growing demand for non-invasive diagnostic methods. On December 2024, TruDiagnostic, a global pioneer in advanced epigenetic research, announced a significant leap in precision medicine: the discovery of Epigenetic Biomarker Proxies (EBP). Using only a single drop of blood, this revolutionary method of assessing biological activity provides previously unheard-of disease prediction and diagnosis capabilities. TruDiagnostic has generated over 1,600 EBPs using cutting-edge DNA methylation analysis to act as proxies for clinical test findings, metabolomic and proteomic measures.

Competitive Landscape and Key Competitors

The DNA methylation detection technology market is characterized by a fragmented structure, with many competitors holding a significant share of the market. List of major players included in the DNA methylation detection technology market report are:

o Sysmex Corporation

o Bio-Rad Laboratories, Inc.

o Illumina Inc.

o Agilent Technologies Inc.

o Exact Sciences Corporation

o QIAGEN N.V.

o Abcam Limited

o New England Biolabs

o F. Hoffmann-La Roche Ltd

o Revvity, Inc.

o Thermo Fisher Scientific, Inc.

o EpiGentek Group Inc.

o Pacific Biosciences Inc.

o Diagenode Diagnostics S.A.

Buy Your Exclusive Copy Now:

Major strategic developments by leading competitors

AnchorDx: On 13 November 2023, AnchorDx, a leading diagnostics company developing cancer early detection tests, announced a long-term collaboration with DiaCarta, a precision molecular diagnostics company and developer of novel oncology and infectious disease tests, to develop and commercialize cancer screening products globally. AnchorDx and DiaCarta will work together to develop and commercialize molecular diagnostic products for the global market. The collaboration will use each company’s own DNA methylation and mutation detection tools.

Watchmaker Genomics: On 30 August 2023, Watchmaker Genomics, a supplier of innovative molecular analysis products, has announced a multi-year, co-exclusive agreement with Exact Sciences Corporation, a leading provider of cancer screening and diagnostic tests, to develop and commercialize the breakthrough DNA methylation analysis technology, TET-assisted pyridine borane sequencing (TAPS). Watchmaker will use its expertise in DNA-modifying enzyme engineering to improve TAPS chemistry, allowing for advanced applications such as cancer screening and minimal residual disease (MRD) diagnostics.

Unlock the Key to Transforming Your Business Strategy with Our DNA Methylation Detection Technology Market Insights –

• Download the report summary:

• Request customization:

Navistrat Analytics has segmented global DNA Methylation Detection Technology market based on Product, Technology, Application, End-Use, and region:

• Product Outlook (Revenue, USD Billion; 2022-2032)

o Instruments

o Software

o Consumables

a. Kits and Assays

b. Reagents

• Technology Outlook (Revenue, USD Billion; 2022-2032)

o Microarray

o Polymerase Chain Reaction (PCR)

o Sequencing

o Others

• Application Outlook (Revenue, USD Billion; 2022-2032)

o Clinical Research

o Diagnostics

o Gene Therapy

o Others

• End-Use Outlook (Revenue, USD Billion; 2022-2032)

o Pharmaceutical & Biotechnology Companies

o Hospital & Diagnostic Laboratories

o Research & Academia

• Regional Outlook (Revenue, USD Billion; 2022-2032)

o North America

a. U.S.

b. Canada

c. Mexico

o Europe

a. Germany

b. France

c. U.K.

d. Italy

e. Spain

f. Benelux

g. Nordic Countries

h. Rest of Europe

o Asia Pacific

a. China

b. India

c. Japan

d. South Korea

e. Oceania

f. ASEAN Countries

g. Rest of APAC

o Latin America

a. Brazil

b. Rest of LATAM

o Middle East & Africa

a. GCC Countries

b. South Africa

c. Israel

d. Turkey

e. Rest of MEA

Get a preview of the complete research study:

MENAFN27072025008152017457ID1109847281