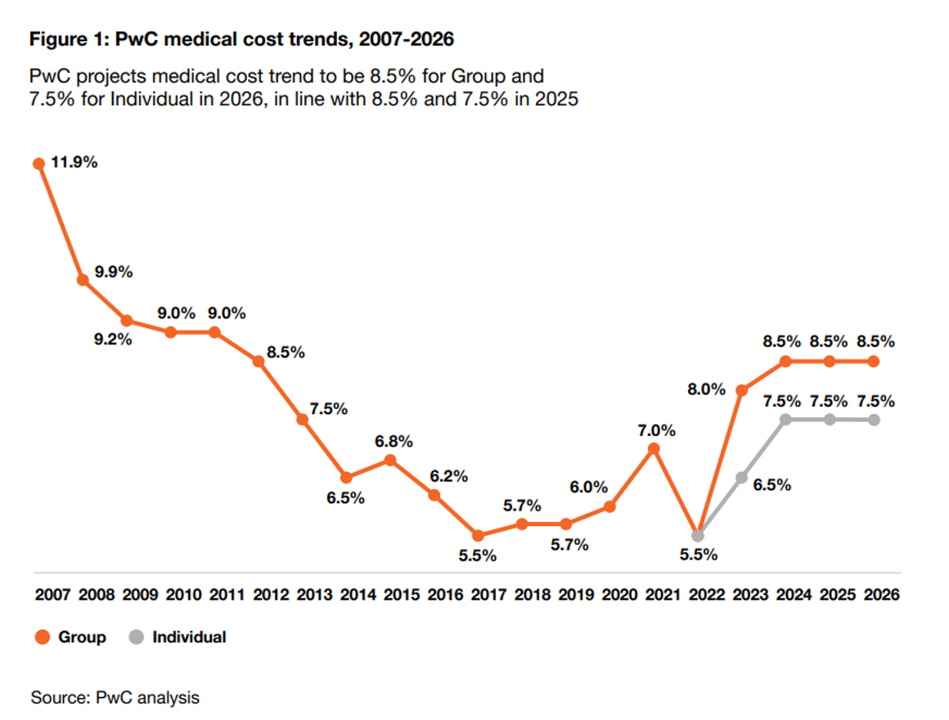

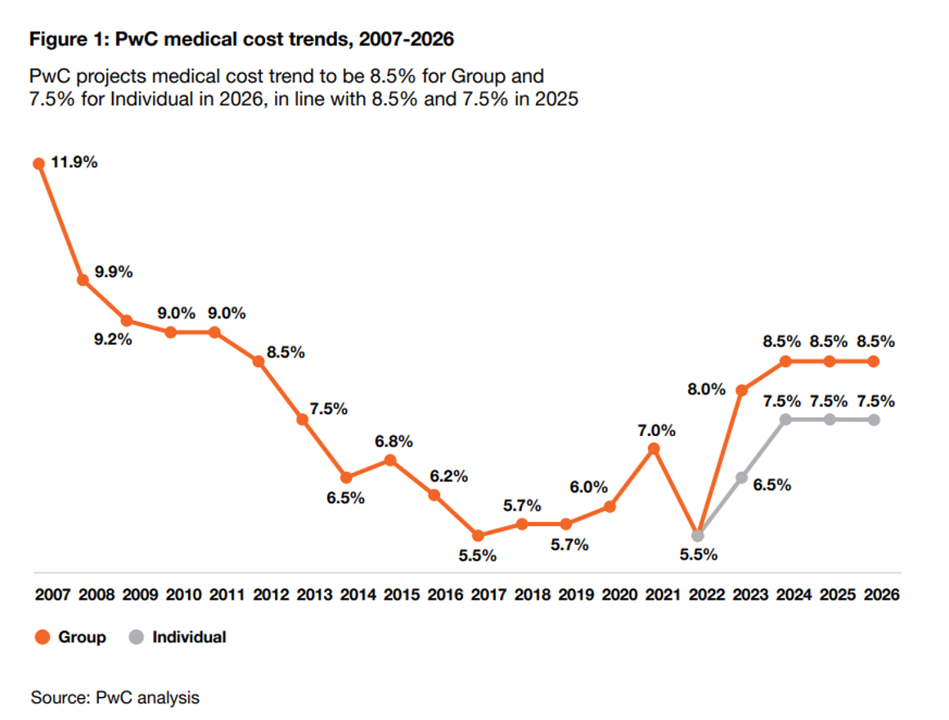

For the third year in a row, medical cost trend — the expected increase of health care costs by health plans — will be 8.5% for group health insurance.

This contrasts with a low of 5.5% in 2022 when cost trend dipped coming out of the COVID-19 pandemic….then shot up to 8.0% the following year in patients’ healthcare catch-up mode.

Welcome to Behind the Numbers 2026, the annual medical trend report from PwC.

What’s continuing to drive up health care costs? PwC identifies 4 medical cost inflators, and 2 “deflators” (these being the introduction and use of biosimilars for prescribed therapies, and more tightly managing the cost of care through utilization management).

The inflators are:

- Hospital costs, compounded by healthcare workers’ wages, medical supplies (think: hospital gowns and paper-based products now with tariff impacts — in sum, supply chain pressures), and general operating costs pressing upwards (see the second chart labeled “Figure 4”)

2. Hospital revenue cycle management: those hospitals and health systems embracing change in terms of declining federal money are diversifying and expanding services for new revenue sources. In addition, hospitals attending to growing margins are seeking as much income from commercial payers as possible.

3. New therapeutics, GLP-1s and others, may portend a new inflationary (price-increasing) era for prescription drugs: In the words of PwC, “Many of these drugs, while significantly improving the quality of life and health of individuals, in some cases are also creating new classes of chronic and life-long disease treatment that will likely lead to persistent effects on medical cost inflation.”

In addition to the GLP-1s which will have additional conditions approved for on-label use in the coming years, upward cost pressures will come from therapeutic areas including oncology, immunology, and cardiovascular. And,

4. Surges in behavioral health care demand and service provision. As the chart Figure 14 from PwC’s report clearly communicates, behavioral health claims growth has been upward and to the right, with demand growing for both inpatient and outpatient services since January 2023.

PwC notes that utilization is up across most mental health categories, including the top-growing areas of anxiety and depression and developmental issues.

Telehealth has played a starring role in enabling this growth for access and equity.

But providers of behavioral health services are concerned about payer rate reductions and low rate increases which are causing serious financial pressures on the behavioral health supply-side. Plans expect a 10-20% growth trend looking to the next year, causing, in the words of PwC, “the behavioral health sector fac(ing) an uphill battle to maintain access and quality oca care int he years to come.”

Health Populi’s Hot Points: = The chronic 8.5% of medical cost trend 3 years in a row compels health care stakeholders to continue digital transformation with a strong focus on lower costs, improving productivity, and supporting clinician well-being. Necessity being the mother — as the quote from the PwC report suggests here.

The Trend to Watch for this is the use of AI deployed across the health care ecosystem – especially fruitful, PwC believes, if design and implementation attend to data privacy, algorithmic bias, and robust regulatory frameworks.

But “Behind the Numbers” for, say, 2027, PwC warns that this (intense) adoption phase for AI in health care may lead to “inflationary pressure in the short term.”

How long is “short?” And how large a % of inflation do we expect?

As we have reached 8,5% year-on-year for medical cost trend, AI might well push trend upwards toward double-digit medical cost inflation territory. As we’ve seen for decades, adding new technology into health care has more often than not added costs. The irony will be, beyond the “short term,” whether AI will prove to be cost-saving or cost-increasing. If the latter, we can hope, at least, for achieving better value-for-money for the already- high cost U.S. tab for health care, in terms of population health outcomes, public health, maternal and newborn health, and longevity for flourishing lives.