On this U.S. Labor Day 2025, the physical and the fiscal, with the mental, converge as I ponder what working Americans are facing….packing kids up for school, sorting out college payments and loans, dealing with rising costs of daily living, and feeling a growing pinch of what President Trump’s tariffs have had in store now that they’re hitting SKUs around the household.

This post will cover most days this week as my own workflows will be heavy as clients return to face returns-to-work and updating scenario plans.

We start this post with a headline: “Why Hospitals Are Hiring ‘Revenue Bounty Hunters,’” seen earlier this week in my email in-box.

It took me aback — not so much the general subject matter of hospitals seeking medical bill payments from patients, but the concept of “bounty hunters” coming to a health care provider near you. The convergence of revenue cycle management, unpaid medical bills, AI, and tariff impacts fueling U.S. consumers’ eroding financial health prompted the plotline of this post published for Labor Day 2025.

It’s timely to talk about American workers and peoples’ prospects for financial well-being — which directly impacts physical, mental and social health as we enter this new month of 2025 and consumers’ return to school, return to work, and pivot toward the fourth quarter which is usual prime time for household spending on holidays (from Halloween to Thanksgiving and so on) and winter vacations.

First, the overall state of the U.S. consumer, described by Newsweek today. “Americans Are Gloomier Than Ever About Their Financial Future,” the headline warns. That’s because, “Cash-strapped Americans are growing increasingly pessimistic about their financial future, as data continues to reveal declines in consumer confidence and heightened anxieties about the economy in 2025,” Hugh Cameron explains.

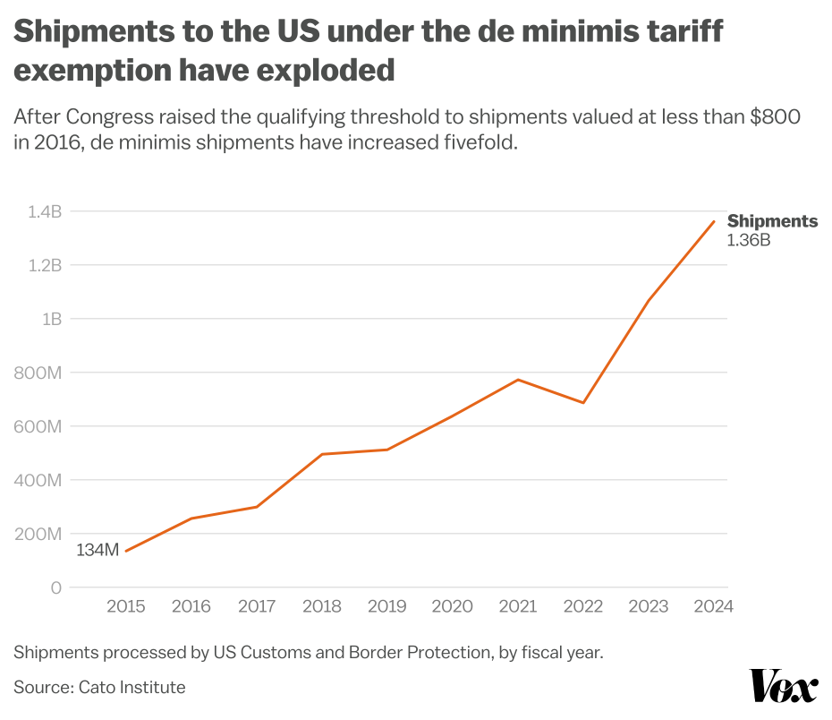

Both The Conference Board and The University of Michigan’s tracking of consumer sentiment show downward trajectories from the start of 2025, with the outlook continuing negative as tariffs’ impacts start to hit more line-items in family budgets, from appliances and large capital dollar spends to smaller items hit by the end of the “de minimis” tariff break (explained below).

1. Revenue Bounty Hunters for consumer medical payments

Start with the story that started my mental flywheel spinning: Allison Bell’s coverage in BenefitsPro (dated August 25 2025) addressing how, “frustrated providers have hired ‘revenue bounty hunters’ who use artificial intelligence systems to look for underpayments. The firms then help the providers try to collect the missing payments,” Allison explains.

Behind this, if you want to delve more deeply into two shadow industries enabled by the cost-increasing U.S. health care system, described in detail by Craig Gottwals in his informative Substack essay:

- Shadow Industry #1: Faux Network Pricing, and,

- Shadow Industry #2: AI-Backed Revenue Bounty Hunters.

These two stakeholders are taking full advantage of the lack of transparency in American health care in a sort of “subterranean cage fight.” But without and until payors demand change in the form of transparency, direct primary care, cash pay options, and other major changes to the “cage fight” dynamics, Craig warns:

“This arms race isn’t slowing down. On the contrary, it’s growing hyper-exponentially…Instead of evolving toward transparency, we’re coding our way into deeper opacity.”

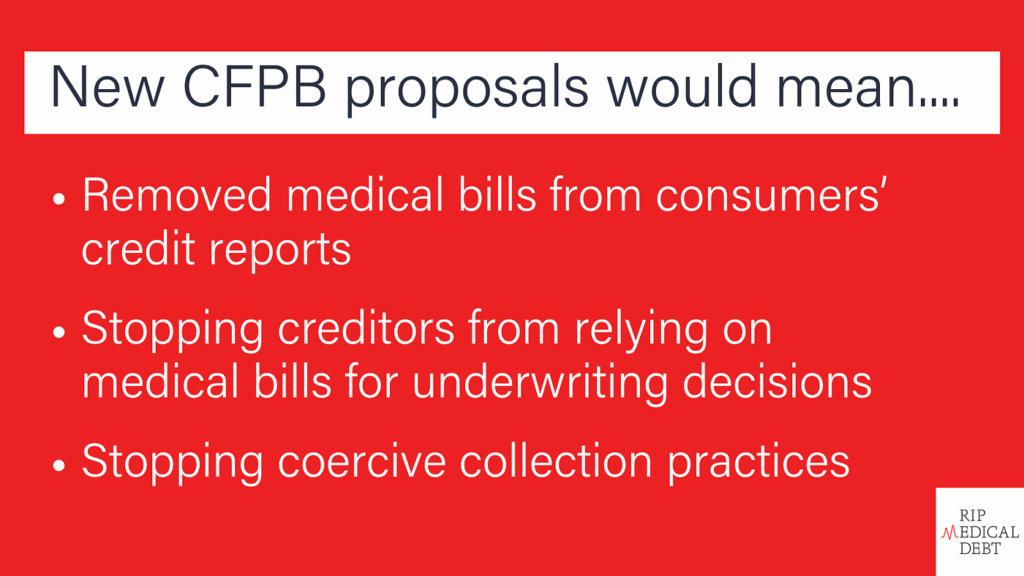

2. FICO scores and medical bills

When it comes to FICO scores, medical debt has played a big role in personal bankruptcies and some Americans’ inability to dig out of mounting medical bills on top of other household spending. In January 2025, the Biden-Harris White House announced that the Consumer Financial Protection Board (CFPB) would remove medical spending from U.S. consumers’ FICO score calculations, asserting in her announcement that,

“States and localities have leveraged American Rescue Plan (ARP) funds to support the elimination of over $1 billion in medical debt for more than 700,000 Americans. These actions build on the Vice President’s (Harris’s) call to action for states to reduce the burden of medical debt, including by directly purchasing the debt from providers and third parties. Overall, jurisdictions are on track to eliminate roughly $15 billion in medical debt for up to nearly 6 million Americans.

“No one should be denied economic opportunity because they got sick or experienced a medical emergency. That is why President Biden and I cancelled over $1 billion in medical debt – part of our overall plan to forgive $7 billion by 2026 – with support from our American Rescue Plan.”

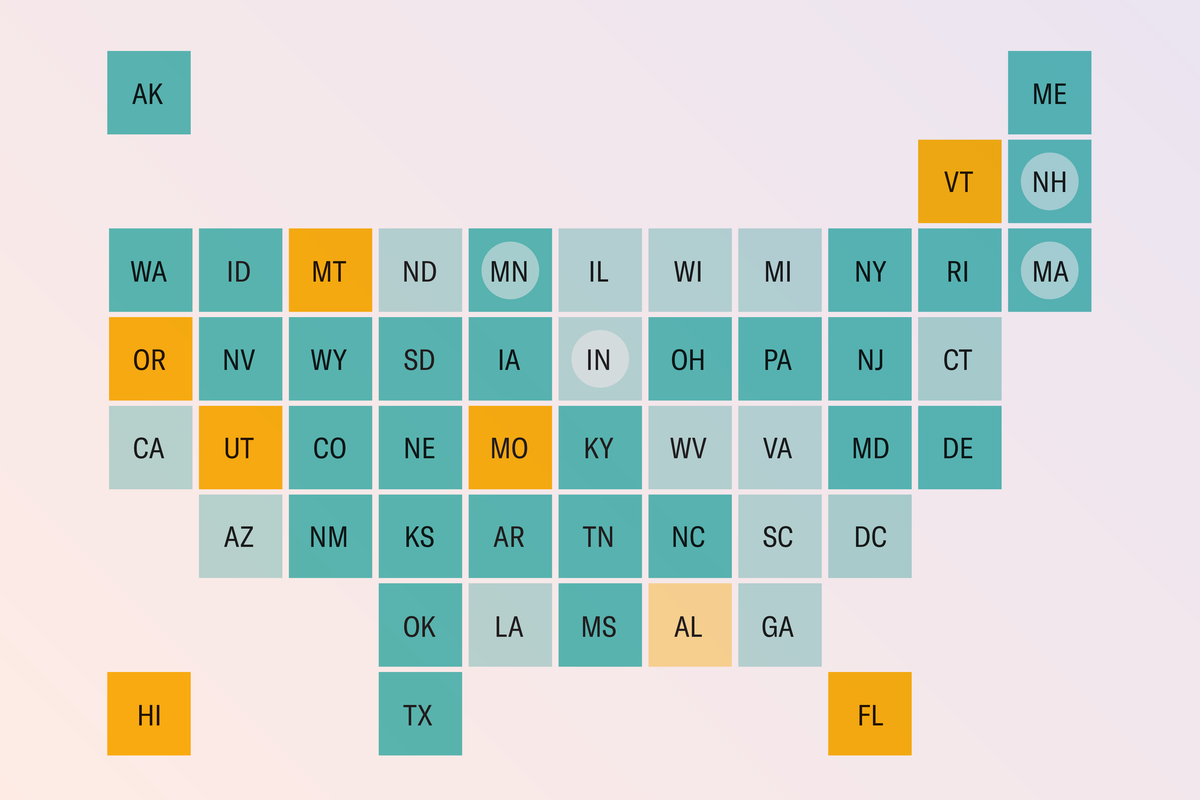

In our “Don’t Blink” era of breaking news emanating from the White House many times of the day, President Trump’s administration overall approach to deregulating financial services and cutting much of the CFPB staff and budget led to a July 2025 lawsuit judgment reversing the Biden policy on medical debt such that medical bills are now being added back into FICO scores.

3. The Rise of Cute Debt (BNPL)

Add into the mix the so-called “Rise of Cute Debt,” as coined by The Atlantic essayist Annie Joy Williams this month in the magazine. The rise that Annie talks about is that of women taking on debt through “buy now, pay later” credit spending (BNPL).

Women’s financial health in the U.S. tends to be lower than men’s across most metrics, from current salary levels (#payequity) to lifelong savings being less than men’s (think: the time value of money compounding each year, but lower salaries at work). “Cute debt” in the form of buy now, pay later can creep up for people (in this case, women consumers) and bite into everyday spending for basic needs – home payments or rent, utilities, food – compounded negatively by inflation and tariff impacts of upward-priced goods.

4. Tariffs’ impacts on U.S. consumer household spending will start hitting home this month….and through the 2025 holiday gift season

Smarty, the online coupon/discount portal, conducted a survey among 1,024 U.S. consumers 18 and over in June 2025 to gauge peoples’ views on spending and tariffs. The finding: “Labor Day 2025 emerges as a ‘tariff survival’ shopping holiday,” Smarty summarized, expecting a “dramatic transformation” among American shoppers who see today as a last chance to be “tariff proof” — that is, get ahead of anticipated tariff impacts on household spending.

Health Populi’s Hot Points: We enter autumn and soon the fourth quarter of 2025 — typically a consumer-spending outflow for all the autumnal and winter holidays and vacation time — more sober across all lenses on personal and family health. Finding joy every day, in small things or bigger, is one of the Jobs of which we should stay mindful. For me this morning of Labor Day 2025, it’s seeing the start of maturing treetops turning their first shade of russets and reds….the FaceTime call we’ll have later today with our kids….the wonderful brunch we just shared on our balcony in 68 degree breeze….and time to walk later in that (warming up) breeze, on the trail path in our neighborhood, with time to count those blessings as we chat with neighbors also enjoying this divine weather and time off.

As for tomorrow….work awaits. But we are blessed to have meaningful work, supportive and generous colleagues, and the opportunities to grow and share along the way.