As of August 2025, U.S. patients of all demographics and geographies face many uncertainties with respect to their care. Issues such as health plan coverage, prescription drug costs, and access to services, among other challenges, continue to re-shape patients-as-health-consumers seeking transparency, clinical choices, and trust-worthy relationships with touchpoints in their personal health ecosystems.

Four just-breaking stories across the health/care ecosystem illustrate several of these uncertainties and forces in U.S. health care — some adding friction and angst in a patient’s life, others perhaps providing some relief for certain health consumers. These news items address health care costs in retirement, the impact of tariffs on consumer health care spending, the continued challenge of patients delaying care due to costs, and hints from Roche, the pharmaceutical company, exploring an opportunity to channel prescription drugs directly-to-consumers (DTC).

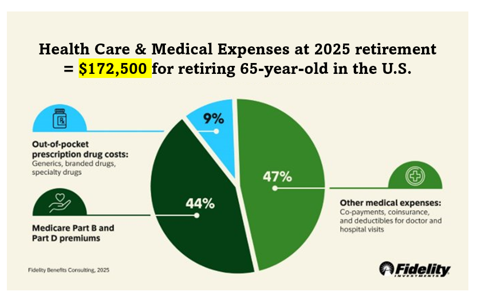

Start with Fidelity Investments’ publication of the 24th annual Retiree Health Care Cost Estimate, calculating that 65-year old U.S. worker retiring in 2025 will expect to spend an average of $172,500 on health care and medical expenses through retirement. This is a 4.0% + increase over the 2024 number. Note that this number does not income long-term care expenses.

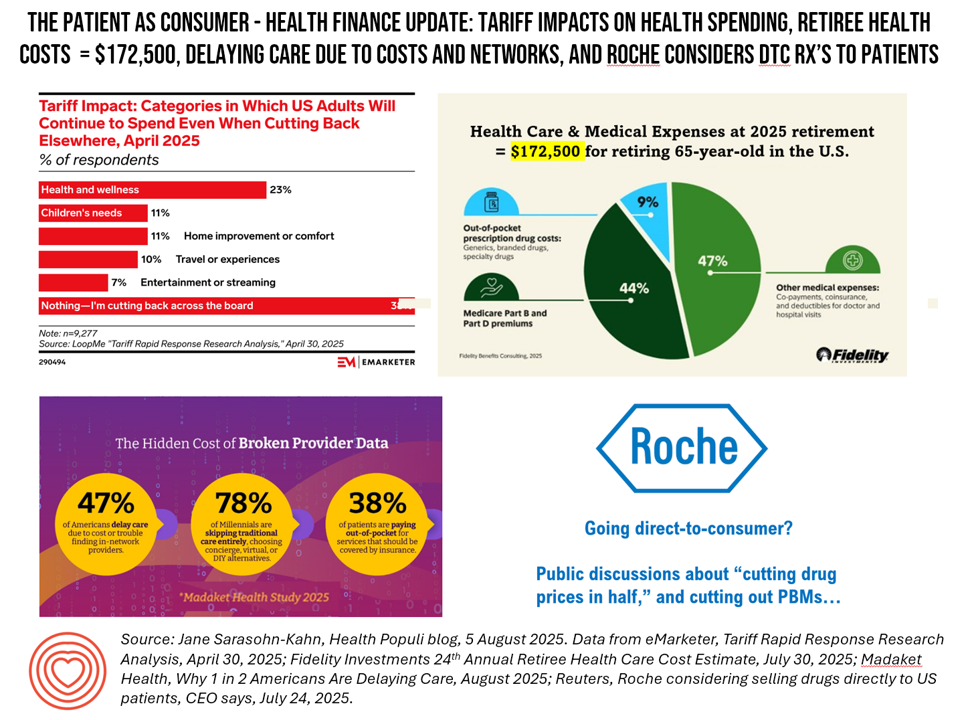

U.S. consumers also have tariffs on their mind, joining shoppers’ continued concerns about inflation (especially entering go-back-to-school and -college retail seasons, and early holiday shopping).

eMarketer points to LoopMe’s research into U.S. consumers’ responses to tariffs, finding that peoples’ spending on their health and wellness will not be as negatively impacted by tariffs as their spending on entertainment of streaming, travel and experiences, home improvement, or children’s needs. Fully 4 in 10 people still plan to cut back across the board.

I’ve noted here in Health Populi and on recent podcasts how tariffs can impact American’s health care spending in general, and in particular most recently a negative impact on U.S. spending for pharmaceutical products that are imported from Europe — facing a stiff tariff on pharma exports. Note that about one-half of U.S. Rx supplies come from European sources.

Even with some inelasticity of demand for health care and wellness services and products, nearly one-half of U.S. adults still delay care due to cost — with another barrier to care being the ability to identify in-network health care providers on health plan members’ approved lists.

A new study from Madaket Health, a billing company, identified this nuance especially acute among younger patients — specifically Millennials — 4 in 5 of whom are skipping traditional care in favor of concierge, virtual or DIY alternatives.

Finally, with an eye toward more consumers taking advantage of DIY and DTC platforms for medicines access (think: GLP-1s’ distribution turbocharged by direct-to-consumer models like Hims & Hers, Ro, and others),

In his recent discussion with investors and industry analysts, Roche CEO Thomas Schinecker discussed the Swiss company’s broad thoughts on the issue. “Something has to be done here to take out these people that are just trying to make money,” Schinecker said in the call — referring to PBMs, pharmacy benefit managers. “It can’t be that 50% of profits go then to intermediaries that take zero risk.”

Health Populi’s Hot Points: Together, these four stories continue to paint out the U.S. patient-as-payor and -consumer, taking on more clinical and financial risk and responsibility — and with greater uncertainty comes greater risk.

Given the many uncertainties and market moves, in my scenario planning matrix on consumers as health citizens, I’ll still point to the lower two quadrants — patients feeling as castaways in a fragmented, bureaucratic non-system, or patients acting as CEO of their health care — with a lot of DIY touchpoints to sort out in an individualistic landscape.

“America’s consumers are getting thrifty again,” yesterday’s Wall Street Journal explained in a story featuring the bar chart here — indicating that rising prices and inflation is the top issue facing consumers, following by tariff policies for another third, and the ability to make ends meet for 1 in 5 people in the U.S.

See the cost of health care ranks 5th on the list, albeit lower than the top 3 financial challenges and the 4th, immigration.

While the costs and workflows of healthcare in America will feel much like retail — that is, with people considering out of pocket costs and needing to budget health spending in the larger context of household and family budgets — it won’t be a scenario of “Retail Health for All” which is delivered (in these futures) in a broader community-social community context.

And nor will people feel like full-on Health Citizens — just the opposite, until peoples’ sense of social cohesion and community shift northward.