- 1.3 billion people already own smartphones supporting eSIM globally today

- Travel eSIM provisioning is projected to rise from 70 million to 280 million by 2030, report claims

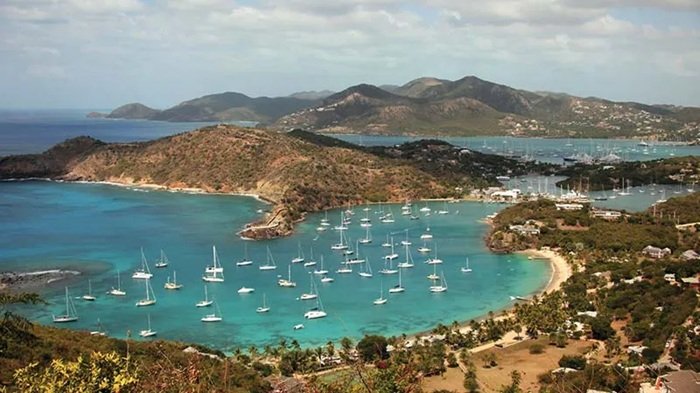

- Specialist providers target international travelers, offering lower-cost alternatives to traditional roaming

The global eSIM market is showing signs of dramatic expansion, with current forecasts suggesting that 1.3 billion people already own a compatible smartphone, a figure expected to surpass 3 billion by 2030.

New figures from analyst firm CCS Insight say travel eSIMs in particular are driving growth, with the number provisioned worldwide projected to increase from 70 million in 2024 to 280 million by the end of the decade.

Market value is expected to exceed $4.4 billion, fueled by rising international travel and higher familiarity with eSIM technology.

Disruption for traditional operators

Specialist providers such as Airalo and Holafly are aggressively targeting international travelers, offering lower-cost alternatives to traditional roaming plans.

In April 2025, Airalo reported 20 million customers, effectively doubling its base in less than a year.

Meanwhile, some airlines and other travel-focused companies have started offering their own eSIM services, further challenging mobile operators’ once-secure roaming revenues.

Only a handful, including Vodafone and Orange, have responded with comparable eSIM options, with analysts suggesting operators must carefully balance defensive strategies with opportunities to engage new or lapsed customers, expand into additional countries, and diversify offerings.

CCS Insight found North America is leading adoption, with nearly a fifth of international trips already using travel eSIMs.

Forecasts indicate this will rise to 41% by 2030, reflecting the widespread use of eSIM-capable devices, including eSIM-only iPhones introduced since 2022.

As usage spreads, the best eSIM choices for Europe and Asia, which are very large markets, will also likely influence global purchasing decisions.

Also, with the proliferation of eSIMs, the initial advantage held by travel eSIM specialists may diminish, leading to commoditization.

Analysts anticipate consolidation and diversification within the sector, as saturation reduces opportunities for disruption.

For global mobile operators, declining roaming fees represent a clear threat to revenues – however, it is also a chance to rethink business models and explore new services in a fast-changing landscape.

“Travel eSIMs are turning the traditional roaming market on its head. The influx of new players, a sharp fall in prices, and the move toward remote provisioning are changing the way people think about getting connected when they go away,” said Kester Mann, director of consumer and connectivity at CCS Insight.